The nature and structure of unbounded upside narratives

Many children learn how to make-believe.

Perhaps it’s a complex skill?

Make-believe combines narration, reason, and teleportation. One has to be able to suspend disbelief, to budget for enough magic (but not too much if they want to include anybody else) to escape from the unwanted technical features of reality, and to visit places and situations that do not exist. Asking what if, and improvising with AND THEN, over and over again, UNTIL FINALLY something fantastic is realized, is an ensemble of skills.

The future is a great canvas for make-believe.

Because anything is possible in the future! Just imagine the possibilities!

The future does not exist in a material sense. It is not real. How do we approach things that are not real?

Saying things that isn’t was at the core of Gervais & Robinson’s (2010) The Invention of Lying. Barnum (1886) explains that all Americans are a little bit crooked with a cultural tolerance for a bit of humbuggery. Thiel is quoted as saying, in reference to Trump, “I tend to think that the inaccuracies President Trump tells are basically exaggerations of the truth”.

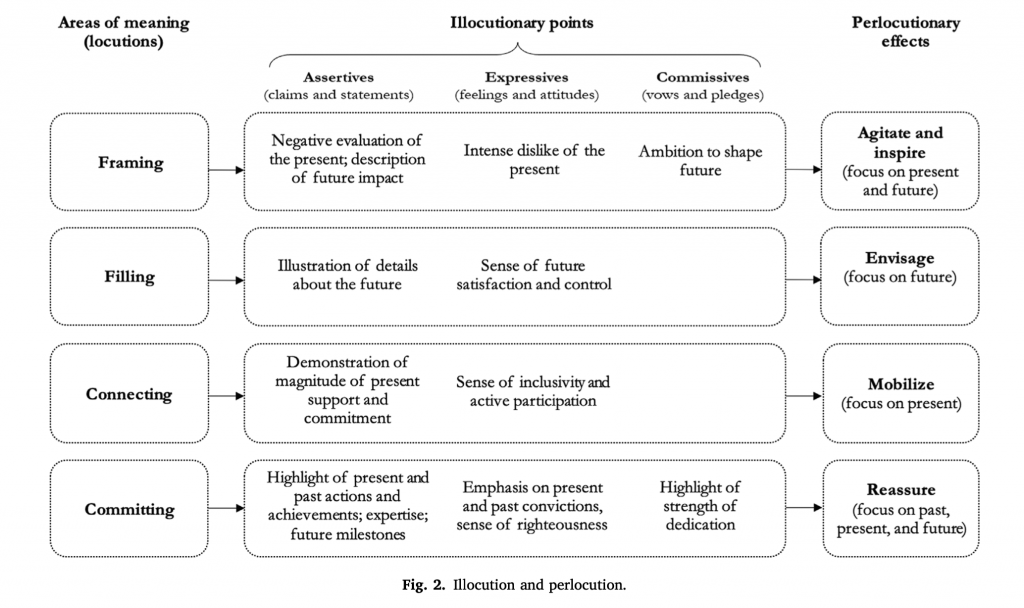

Liubertė, I., & Dimov, D. (2021) gifted us this fantastic chart breaking out how an entrepreneur uses to words to describe Futurescapes.

Let’s accept that we all say things about the future and we can argue that there are different moral assessments of that (Haidt, 2012). Let’s talk about a feature of many entrepreneurial Futurescapes: The Unbounded Upside.

The Unbounded Upside

I think a lot about how magical Radio must have been in the early 1920’s. You could broadcast anything! Imagine the possibilities! And early innovators did. (And they never left: HAM radio persists to this day!) They believed that this time, unlike with telegraphs, it’ll be different! No wires! It’s Wireless! But it never is different (Wu, T., 2011). Commercial radio came and the government stepped in to assist in the centralization. And what a boom it was! Consumer radio enabled mass advertising and waves of popular musicians. And later, it was used as an instrument to radicalized entire populations and even contributed to a genocide (Nzitatira et al, 2024).

What a ride though! RCA, which made radio sets and equipment, their shares started off at $1.50 in 1921 and peaked somewhere around $568 in September of 1929.

The belief that the upside is completely unbounded fertilizes the bubble because it provides the ambitious the permission structure to try ambitious experiments. It also enables the competent to just maybe succeed too!

The Unbounded Upside Industrial Complex: Big Hubba Bubba Dubble Bubble

“A recent study from THE CAGR INSTITUTE predicts that demand for this new technology you’ve heard your rideshare driver reference will exceed 980% CAGR by 2031!” – HotHype Magazine.

“If your business isn’t already agentically VR enabled in generative metaverses backed by decentralized autonomous organizations secured by NFT’s and powered by AI, you’re already dead in the water!” – Chad Chadwickon von Chadinson.

It’s easy to satirize. And yet entire businesses are built off it. Some people pay research firms big cash money to make bold claims about growth rates. And those research firms are certainly incentivized to research reasons as to why those bold claims could be plausible, and to prescribe all sorts of immediate take away action items to bring to committee. And then founders cite those studies as certitudes. After all, if the CAGR INSTITUTE says that by 2031 half of all US households will use a 3D printer to print food, then it must be true! You don’t want to be left behind do you? And who’s to say if those forecasts are plausible? Motivated reasoning is certainly a form reasoning. One might even say that an aggressive forecast is make-believe.

Sound familiar? Consider some of what we’ve just lived through.

The argument that they needed everybody’s Intellectual Property because they were building an AI Godhead that would solve scarcity once and for all, lifting all humans out of misery and ensuring sustainable Universal Basic Income (UBI) was relentlessly promoted. And, when it turns out that you can’t just brute force a Godhead into existence (who knew?!?!), they shifted those goalposts, offering porn and, indeed, some solid productivity improvements. Superintelligent Jazz Hands.

Promises of unlimited upside permeate the decade: AI Data Centers….in space. Colonizing Mars. Unlimited Fusion Energy. Immortality.

The unboundedness is the point because infinite upside implies zero risk. By making the risk of the downside vanish into a singularity (see what I did there?) one enables the most audacious to try.

And that’s useful!

Make. Believe.

Consider this mix of quality attributes: gullibility, child-like awe, whimsy, kayfabe, imitation-conformity, humbuggery, and participatory imagination. Select a few to apply a population.

Imagine the distributions of those qualities distributed across different populations in different places. Where might the most abnormal concentration of such people coalesce? Would those concentrations enjoy advantages? What might those advantages be?

Well, for one, I’d predict a higher rate of learning in populations greater willingness-to-believe and willingness-to-make-believe, and as a direct result, higher variance in the sustained compounding of that learning. They, themselves, would have a different rate of change. And all the advantages that go with that.

Where is such a place? If only there was somewhere new? A New World perhaps? The Lehman Trilogy (the book is a great read too) hit me pretty hard as that place. Where else but America that you can think those big thoughts? I think about the Lehman’s involvement in the Panama Canal. Let’s just tweak the physical geography just a bit there and totally change the site rent of the planet. Profit! The energy of the 1920’s felt like that too (Sorkin, 2025) as Radio and CPG’s boomed together. Expectations can be generative.

So there’s an advantage, clearly, to possessing an imaginative and audacious society.

Monetarist Dreams

There was a time when Monetarists argued that they had finally defeated the business cycle. The argument went that because Capital had better information about the state of the economy, they could make better predictions about capacity, and as a result, would self-regulate their behaviour. They would manage their growth so as to avoid causing the business cycle. In that way, the business cycle was an information problem.

I swallowed that idea. I didn’t even chew. My gullet had already been lubricated by differential partial equations and it still seemed like the world could be better. If people only knew better, they’d do better!

Well, the unbounded optimists have a say about the business cycle too.

We have information that unbounded expectations aren’t rational. The psychological trigger of using FOMO (including Prestige-rooted exclusivity games) are known (You’re reading it here of all places….). Hypers are gonna hype. People are going to get excited about the possibilities. Bubbles are gonna Bubble.

So it isn’t purely an information issue. Innovator dreams and monetarist nightmares. Who knew?

Timing The Upside

Keynes (1923) wrote “In the long run we are all dead.”

Consider the long run of aviation. The technological trigger likely predated December 17, 1903 because the Wright’s needed a gasoline engine light enough to lift. Then they wrapped that engine on wood, bike chains, and canvas. Artificial flight! Imagine the possibilities! And many did. In 1920, there were 10 aviation stocks. By March 1929 there were over 125. And on the other side of that bubble, we got commercial and cargo aviation and jet travel. If you bought stock in 1920 and sold in February 1929, then you did well. If you HODL through it, well, perhaps you weren’t ultimately wrong, in the long run, you just mistimed it.

In the long run, holders of paper money from the Banque Royale and the Compagnie d’Occident weren’t wrong about the potential of the Mississippi River Valley. After all, it’s geographic basis of a modern superpower! But they got the timing wrong. (Most of those investors never lived to see the French Revolution, little though the American War of Independence…so, PARTIAL CREDIT, good effort.)

Sure, in the long run: O’Neill Cylinders for Everybody! Why not!

The promoters of the unbounded upside aren’t necessarily wrong in the long run.

Good Structure

In the short run, if it’s all gradual incrementalism, one less olive per bottle / 2 inches less leg room, then we don’t ever discover a breakthrough.

And so the unbounded upside narrative mortgages a little bit of the future to generate some progress that wouldn’t otherwise be possible right now.

The nature and structure of the unbounded upside is useful because it suspends just enough disbelief to cause audacity. That’s the point.

And perhaps it really is a complex skill.

References

Barnum, P. T. (1886). Life of PT Barnum. Courier Company Printers.

Gervais, R., & Robinson, M. (2010). The Invention of Lying. Universal Studios.

Haidt, J. (2012). The righteous mind: Why good people are divided by politics and religion. Vintage.

Liubertė, I., & Dimov, D. (2021). “One tiny drop changes everything”: Constructing opportunity with words. Journal of Business Venturing Insights, 15.

McQuaig, L. (2019). The sport and prey of capitalists: How the rich are stealing Canada’s public wealth. Dundurn.

Nyseth Nzitatira, H., Billing, T., & Edgerton, J. F. (2024). How radio affects violent conflict: New evidence from Rwanda. American Sociological Review, 89(5), 876-906.

Sorkin, AR (2025) 1929: Inside the Greatest Crash in Wall Street History–and How It Shattered a Nation. Random House.

Wu, T. (2011). The master switch: The rise and fall of information empires. Vintage.