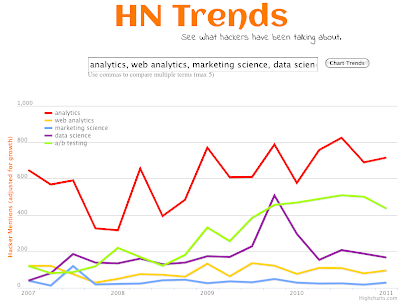

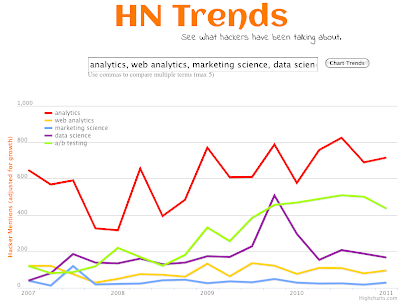

Some excellent work by Jerod Santo and his Hacker News Trend visualizer.

Pretty sweet.

Hacker News is a nice, social curation program. It’s a pretty good indicator of what data developers and hackers are thinking and doing in many markets. It’s one of the main bellwethers of the bootstrap community, and there’s typically a lot of content that I find interesting.

All trend lines that follow are adjusted for size of community at the time.

The first chart, below, describes the persistence of analytics and the rise of specific, applied uses – the a/b test. It also shows that the term ‘data science’, as a category of interest, had a bit of a bubble in late 2009.

That’s great, but how about some perspective? What are some of the biggest topics that dominate HN?

That’s great, but how about some perspective? What are some of the biggest topics that dominate HN?

Check the Y-axis. We’re talking about much higher volumes. Note the rise of apple and the decrease in hack. Mainstays ‘work’ and ‘show’, two keywords I pulled from some of the excellent work MetaMarkets did, hold steady.

Check the Y-axis. We’re talking about much higher volumes. Note the rise of apple and the decrease in hack. Mainstays ‘work’ and ‘show’, two keywords I pulled from some of the excellent work MetaMarkets did, hold steady.

Note the rise of Apple and the rise of Data.

I’ve sandbagged a cluster – outputs of data versus the term data itself.

What do I see?

I see the rise of data, and then flatness. A natural ceiling at sub 10,000 where, possibly, the community won’t tolerate too much of the same thing without becoming OJ’d/Weinered/Lybianed out. Ie. Topic burnout (see the previous charts). It may also be caused by something more sinister.

The rise of data always leads to the dissatisfaction, because data doesn’t answer, all by itself:

- What does it mean,

- What does it mean to me,

- What does it mean for my future, and

- How can I use it to make my future better.

It may be dissatisfaction.

Analytics professionals know how this goes. If there was ever a time to connect marketing scientists, web analysts, and data scientists with hackers and developers, it should be right about

now.

Ideally, we would see more applied analytics terms rise from below, while data begins its slow, inevitable, decline.

In the absence of statistical analysis – am I being fooled by randomness here – or is there really something here?

That’s great, but how about some perspective? What are some of the biggest topics that dominate HN?

That’s great, but how about some perspective? What are some of the biggest topics that dominate HN? Check the Y-axis. We’re talking about much higher volumes. Note the rise of apple and the decrease in hack. Mainstays ‘work’ and ‘show’, two keywords I pulled from some of the excellent work MetaMarkets did, hold steady.

Check the Y-axis. We’re talking about much higher volumes. Note the rise of apple and the decrease in hack. Mainstays ‘work’ and ‘show’, two keywords I pulled from some of the excellent work MetaMarkets did, hold steady.